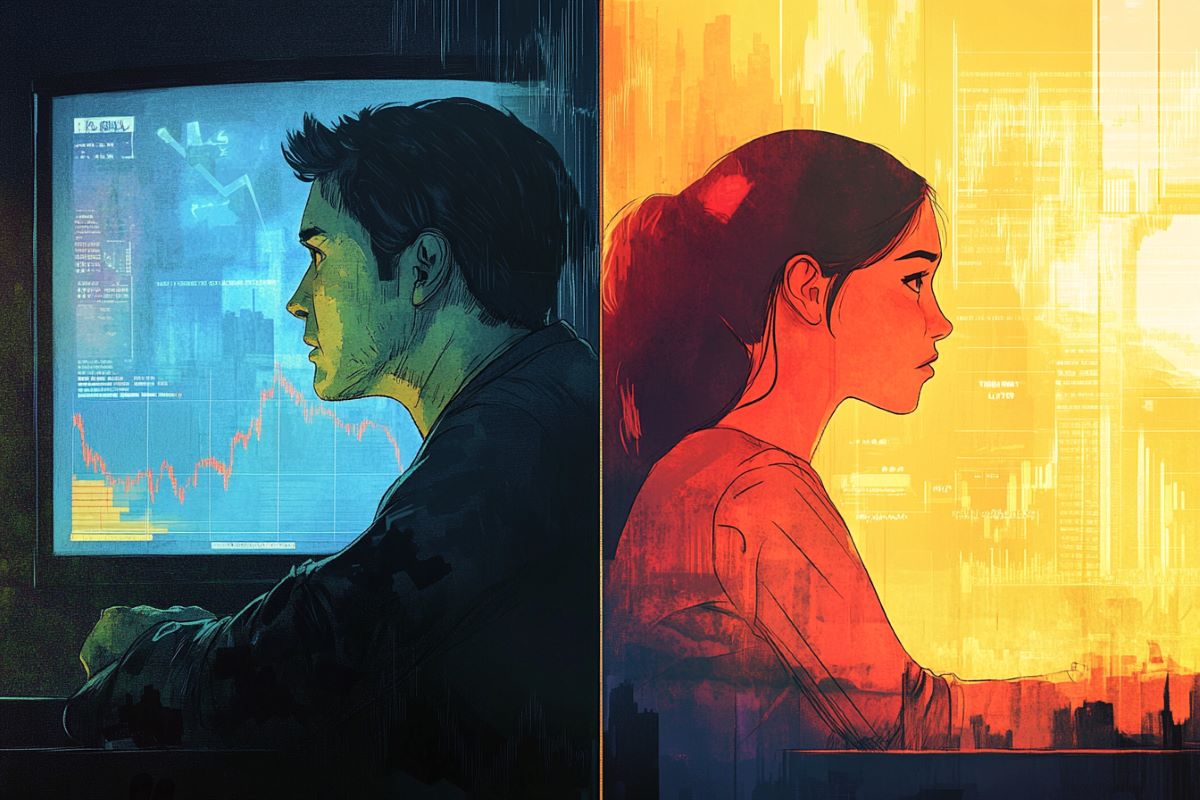

Summary: New research reveals that men are more likely than women to let emotions from unrelated situations affect their financial decisions. After watching emotional news stories, men opted for safer financial choices, while women’s decisions remained unchanged.

This challenges the stereotype that women are more emotional, suggesting higher emotional intelligence may buffer them from such effects. The findings could inform strategies for mitigating impulsive decisions in high-stakes financial scenarios, especially for men.

Key Facts:

- Gender Differences: Men are more likely than women to let unrelated emotions influence financial risk-taking.

- Emotion and Decision: Emotional news stories made men more cautious in financial decisions, but women’s decisions were unaffected.

- Potential Insight: Higher emotional intelligence in women may help them manage emotional carryover effects better.

Source: University of Essex

Emotional news stories have a strong impact on men’s financial decisions, according to new research.

The study, led by the University of Essex, revealed that men are far more likely than women to let emotions from one situation carry over into unrelated risky decisions.

After watching real-life negative news stories, men avoided financial risks even when the decisions were completely unrelated to the news. However, the opposite was true for women, whose decisions were unaffected.

“These results challenge the long-held stereotype that women are more emotional and opens new avenues for understanding how emotions influence decision making across genders,” said lead researcher Dr Nikhil Masters, from Essex’s Department of Economics.

In the study, 186 people watched emotional news stories and were then asked to make risky financial decisions with real money. Interestingly, women’s financial decisions remained unaffected by the emotional tone of the news, while men showed a clear tendency to play it safe.

The findings from this study could shape advice for high-stakes financial decisions.

“We don’t make choices in a vacuum and a cooling-off period might be crucial after encountering emotionally charged situations, especially for life-changing financial commitments like buying a home or large investments,” Dr Masters added.

The research team, which involved academics from the University of Nottingham and Bournemouth University, now wants to investigate why only men are affected by these carryover effects.

“Previous research has shown that emotional intelligence helps people to manage their emotions more effectively. Since women generally score higher on emotional intelligence tests, this could explain the big differences we see between men and women,” said Dr Masters.

About this emotion and decision-making research news

Author: Vicky Passingham

Source: University of Essex

Contact: Vicky Passingham – University of Essex

Image: The image is credited to Neuroscience News

Original Research: Open access.

“Do emotional carryover effects carry over?” by Nikhil Masters et al. Journal of Behavioral and Experimental Economics

Abstract

Do emotional carryover effects carry over?

Existing research has demonstrated carryover effects whereby emotions generated in one context influence decisions in other, unrelated ones.

We examine the carryover effect in relation to valuations of risky and ambiguous lotteries with a novel focus on the comparison of carryovers arising from a targeted stimulus (designed to elicit a specific emotion) with those arising from a naturalistic stimulus (designed to produce a more complex emotional response).

We find carryover effects using both types of stimuli, but they are stronger for the naturalistic stimulus and in the context of ambiguity, providing a proof of concept that carryover effects can be observed when moving away from highly stylised settings.

These effects are also gender specific with only males being susceptible. To probe the emotional foundations of the carryover effect, we conduct analysis relating individual self-reports of emotions to valuation behaviour.

Our results cast doubt on some previously claimed links between specific incidental emotions and risk taking.